by Vlad Cuc

We would start off by mentioning that the article below refers mainly to the taxes paid by a Romanian company (any Romanian company, no matter if it’s owned by a Romanian or a foreign person/company). Besides the taxes presented below, an investor would have to consider the Romanian corporate tax of 16% and the dividend tax of 5% (or 16%). Regarding the dividend tax, this is subject of course to the double taxation avoidance treaties signed with Romania, but also the EU tax regulations.

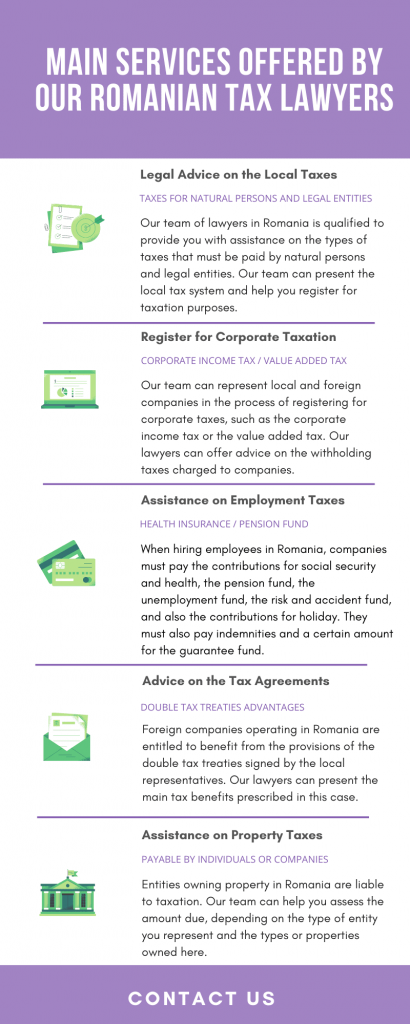

For extensive information regarding the Romanian tax system, you can always request legal advice from our team of lawyers in Romania. Our team is prepared to assist investors on the general tax system applicable here, on the tax compliance system, as well as on the accounting requirements imposed to businesses, which can slightly vary based on the legal entity chosen for incorporation.

Table of Contents

Keeping a “Shareholder Registry” in Romania

The legislation No. 31/1990 stipulates that any SRL company in Romania has to maintain a Shareholder Registry, through the assistance of an administrator, which must register information such as: the shareholder’s full name, the domicile or headquarters of the shareholder, respective share of the share capital owned by the said shareholder, the transfer of any shares or any modifications occurred regarding the shares of the Romanian company.

Maintaining the “Employee Evidence Registry” in Romania

As an employer in Romania, one has the legal obligation to keep the “General Employee Evidence Registry”, which is a document imposed under the dispositions of the law HG 161/2006. After the registration of a new employment contract, the updated registry has to be sent in an electronic format to the Territorial Labor Inspectorate.

This obligation has to be concluded in a period of maximum 20 days since the moment when the employment began. In the eventuality in which various data sent to the Inspectorate is modified, the employer is legally required to provide information on the relevant modifications. This must be done in a period of 5 days since the modifications were added to the registry. The registry must be kept in the electronic format by the employer.

How to keep accounting registries in Romania

The obligation to have accounting registries as a legal entity operating in Romania is stipulated by the Law No. 82/1991. The legislation mentions the following documents as the mandatory registries for local businesses: the Journal-Registry, the Inventory-Registry, the Main Registry and the Fiscal Evidence Registry.

The Journal-Registry in Romania

This is a document which registers chronologically all the financial-economical operations. Any information inserted in the Journal-Registry must include elements regarding the type, the number and date of the document, explanation regarding the respective operations and the debt and credit accounts where the respective amounts were registered.

The Main Registry in Romania

Information is inserted on a monthly basis through re-grouping of the accounts regarding the movement and existence of all the elements of assets and liabilities at a certain date. The Main Registry contains the symbol of the debtor-account and the correspondent creditor-accounts as well the balance of the account for each month of the current year.

The Inventory-Registry in Romania

This type of registry includes all the elements referring to assets and liabilities, which are organized based on their nature, in accordance with the requirements of the law. Our team of Romanian lawyers can assist local companies with more details on the accounting requirements they must fulfil.

The Fiscal Evidence Registry in Romania

The need of having a Fiscal Evidence Registry is applicable for Romanian taxpayers which are required to pay the tax on profit. This has as purpose the registration of all information taken into account when determining the profit subject to taxation, but also the manner in which the tax on profit is calculated. These details are included in the declaration on the payment obligation, which is submitted to the Romanian General Budget.

What are the basic Romania taxes applied to companies?

Companies in Romania are liable to paying various taxes if they obtain a taxable income from commercial activities or other types of activities that are liable to taxation, as per the local law. The system of Romania taxes related to corporate entities stipulates that such entities have to pay the corporate income tax, which is charged at the standard rate of 16%.

Depending on the nature of the business activities, one can pay a tax of 5% on the annual revenue or a tax of 16% on the taxable profit and this is the case of companies developing gambling activities (and other similar activities) or entities operating as nightclubs. The decision on paying one of the taxes is established based on the rate which yields the highest value.

One of the Romania taxes applied to corporate entities is the withholding tax, charged on dividends, royalties or interest. It must be noted that in the case in which a Romanian company pays dividends to another Romanian company, the withholding tax applicable to the transaction is charged at a rate of 5% from the value of the transaction.

In the case in which the withholding tax is applied to the income obtained by non-residents from a Romanian taxpayer, the tax rate will be of 16%, as long as the respective income is obtained from the provision of services delivered in Romania or for services related to management or consultancy.

However, even in the case of non-residents, the withholding tax charged to income obtained from dividends will be of 5%, just like in the case of Romanian entities. The tax rate may vary in specific conditions, when we refer to the taxation of non-resident entities and we invite you to request more details on this subject from our team of Romanian lawyers.

In this particular case, the tax rates and the conditions applied to Romania taxes are influenced by the stipulations of the double tax treaties that were signed by the Romanian tax authorities and their partners and thus, different rates may appear based on the tax residency of the foreign entity obtaining taxable income here.

Who needs to pay VAT in Romania?

One of the Romania taxes that are prescribed under the national tax law is the value added tax (VAT). In Romania, the tax is implemented in the national law through the Law No 227/2015, which implements the Council Directive 2006/112/EC. The VAT is charged to all services and products that are sold on the Romanian market and it is applied to legal entities selling goods or services, as well as to natural persons who obtain a taxable income from the sale of various products.

The standard VAT rate is of 19%, but in the last few years, the legislation was modified by the introduction of reduced VAT rates. Thus, entities that need to pay VAT can be charged at a rate of 9% if they sell water, medical treatments, foods and beverages, certain medical products or at the reduced rate of 5% – applied to hotel accommodation, restaurant and catering services, newspapers, cultural events or sports events.

The legislation on Romanian taxes requires VAT payers to submit VAT returns (on a monthly or quarterly basis). As a general rule, most of the entities have to submit monthly VAT returns and quarterly returns are applied to those that have had a turnover of less than EUR 100,000 in the previous financial year and which did not purchase goods at the Community level.

Romania taxes on employment

With regards to employment, every citizen in Romania who is an employer or an employee must contribute monthly to the social, health, unemployment fund by paying taxes. In this case, the payment obligations for them are comprised of specific types of contributions, presented below by our team of Romanian lawyers:

- the Social and Health Insurance (CASS) – this contribution is paid by the employee at a rate of 10% of the individual’s gross salary to the National Health Insurance House;

- the Pension Fund (CAS) – starting with the 1st of January 2018, the employee is required to pay pension contribution at a rate of 25% of the amount of the gross salary;

- the Unemployment Fund (CFS) – the employer is the one that needs to pay the unemployment insurance, which is paid at a rate of 2,25% of the gross salary of each employee;

- the Disability Fund – the employer must also make the a monthly payment of 4% of the employee’s gross salary;

- it is also necessary to know that the system for Romania taxes imposes an income tax of 10% on the employee’s salary.

IMPORTANT: All the declarations presented in this article are filed with the respective authorities until the 25th of the next month and payments will be fulfilled in the same manner. MHC Law Firm provides reputable tax lawyers in Romania and maintains a close collaboration with more than one Romanian accounting and audit companies. Please contact our Romanian law firm for more details.